We’re at a crossroads! There’s a new product idea on the horizon and it could be the one that unlocks a massive new market. Are we actually considering a … PIVOT? What about our existing loyal user base who has been with us through all the ups and downs!? The customers that made our product and company what we are today!

A pivot of a flagship product is one example of a high stakes decision that a product leader will face. This is a risk vs. reward scenario that could lead to big upside for a company but also threatens to alienate existing users. If it doesn’t work out, those customers may be lost for good.

So how do we make these decisions? How do we weigh the rewards against the potential risks? Is there a foolproof method to make the right decision every time? Well, unfortunately it’s never that simple, but we can make it easier.

I like to refer to this process as ARTSY - this isn’t a fancy acronym for a proven system created by people of fame and success, I made it up so use it or ignore it at your leisure.

A - Accept the Magnitude #

Okay the first part is probably the most important as it sets the foundation on which the rest of the decision process is built. It’s about accepting that this is indeed a difficult decision and recognizing that it is high stakes with big risks. A pivot of this scale isn’t a casual discussion; it demands rigorous analysis and careful consideration of consequences. It is not a simple yes or no.

We’ll need to:

- Use strategic frameworks to analyze potential outcomes

- Identify and weigh critical data points

- Balance risk and ward with a strategic lens

- Communicate with users and stakeholders

R - Reduce & Analyze #

Now that we know what kind of decision we’re making, we need to reduce the problem to assessable parts. The main idea here is to get everything out of our head and into something communicable and readable by others (including our future self).

To do that we are of course going to use our favorite models and frameworks. I can stand on my soapbox forever about these frameworks and how they are only tools, one or multiple inputs into a final decision, and NOT the decision itself. We can use one, all, none, or entirely different frameworks for any given decision depending on the circumstances. Unlike ARTSY, these are not made up by me so we can use them with confidence.

SWOT Analysis #

How would a pivot impact current strengths (Internal, Helpful) and weaknesses (Internal, Harmful)?

- Do we have a weakness it would require significant effort to overcome?

- Do we have an underutilized strength that would play to our advantage with the new product or market?

What opportunities (External, Helpful) and threats (External, Harmful) exist in the new market landscape??

- Are there existing competitors with huge market share?

- Do we have the ability to build a moat? Do our competitors have wide moats we’d have to overcome?

- How big is the new market? What does the growth opportunity look like?

- Would we be an early entrant to an untapped space?

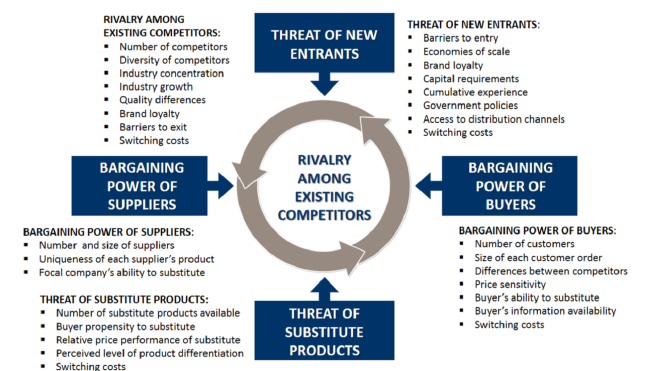

Porter’s Five Forces in the Target Market #

We can use PFF to map the competitive intensity, the potential for new rivals, and bargaining power of both customers and suppliers in the envisioned space.

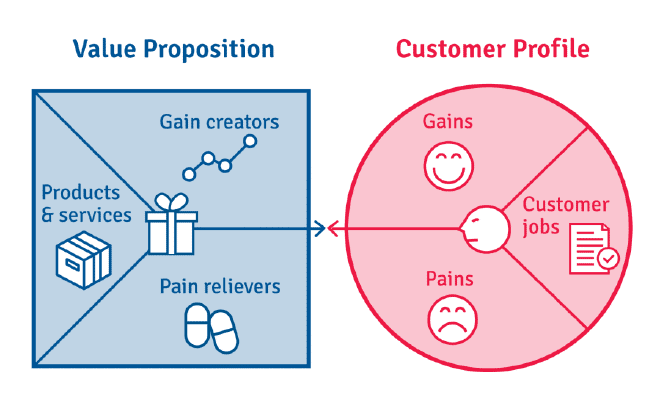

Value Proposition Canvas #

This exercise allows us to examine the “jobs to be done,” pains, and gains for both the existing user base and the potential new market. This helps identify the value exchange and potential friction points.

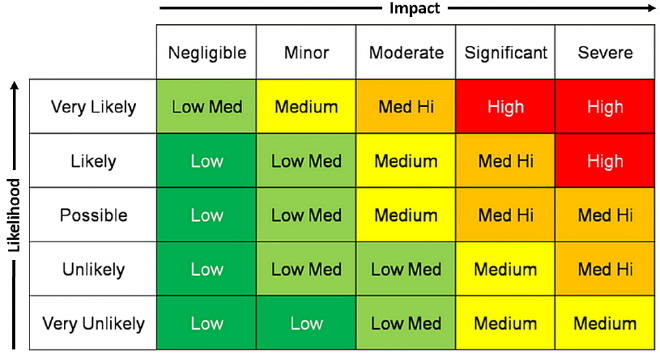

Risk Assessment Matrix #

$$ Risk = Likelihood * Impact $$

Here we systematically identify and evaluate potential risks (market adoption, technical feasibility, competitive response, user churn) based on their likelihood and potential impact. This allows for prioritized mitigation strategies.

T - Think with Data #

Decisions like this must be grounded in data or at least supported with data. Yes trusting our gut is important and there’s been many examples of great product leaders (Steve Jobs, for example) with incredible intuition. But I am not Steve Jobs and we are going to leverage data to improve our odds.

Existing User Base #

- Churn: Customer loss over a period of time (weekly, monthly, quarterly, annually). How would the decision affect our existing user base? Do we have high switching costs? Will we erode user sentiment? $$ Churn\ Rate = Churned\ Customers ÷ Beginning\ Customers $$ $$ Churned\ Subscribers = Ending\ Customers – Beginning\ Customers $$

- Revenue at Risk: What percentage of current revenue, let’s say monthly recurring revenue (MRR) could be lost? What is the long-term value of potentially alienated customers? $$ RAR = Churn\ Rate * MRR $$

- Loyalty and Advocacy: Are these users vocal supporters who contribute beyond direct revenue (referrals, community engagement)?

New Market #

- Market Size: What is the total addressable market (TAM)? What are the projected growth trends? $$ TAM = ARPU * Potential\ Customers $$

- Unmet Needs: What specific problems are underserved in this new market? How effectively does our potential pivot address these gaps?

- Competitive Landscape Analysis: Who are the key players? What are their strengths and weaknesses? What is our potential for differentiation and competitive advantage? I like to graph these. Example axes can be Quality vs. Price or Market Share vs. Growth.

- Price Sensitivity & Willingness to Pay: What pricing models are viable in the new market? Does our value proposition justify the anticipated price point?

- Barriers to Entry: What obstacles (regulatory, technical, network effects) exist in entering this new market?

Strategic Alignment #

- Long-Term Vision Compatibility: How does this pivot align with the overarching company vision and strategic objectives?

- Leveraging Core Competencies: Does this new direction build upon our existing strengths and capabilities? Are there significant resource or skill gaps to address?

- Brand Implications: How will this pivot impact our brand perception among both current and potential future customers?

S - Scale Risks and Rewards #

Alright we’ve got our frameworks, we’ve got our data, now its decision time. Once again, we’re not necessarily making a yes/no decision. Or listing pros and cons and pulling the trigger. We’re weighing potential gains against losses. The real decision probably lies somewhere in between. A path forward can contain shorter term wins toward the larger goal, a phased approach with beta programs, and market testing to validate our hypotheses.

SEE WE DON’T HAVE TO DECIDE AFTER ALL! WHEW PRESSURE’S OFF! Just kidding …

- Quantitative Factors: Attempting to forecast potential revenue gains in the new market against projected losses in the existing one through scenario planning and financial modeling. We did some of this work with our Churn and TAM calculations.

- Qualitative Factors: This one’s a bit more nebulous. Not all impacts can be easily quantified. Think brand reputation, team morale and long-term strategic positioning.

- Phased approach: This one is my favorite and I mentioned it above. Are there less risky alternatives and can we employ contingencies in case things don’t go as planned?

- Come up with a way to test the market, ideally without doing ANY NEW DEVELOPMENT (this includes the dreaded POC that is actually a full product)

- Create a ROADMAP WOOHOO! Wow do I love a roadmap. How can we take incremental steps to get to where we want to go? Are there features that will benefit our current users WHILE steering the ship toward where we want to be? Honestly there isn’t always a way to do this with a hard pivot but I am a MEGA FAN of this strategy.

- Learn the market and mitigate risk

- Define the decision criteria: If there’s a threshold (revenue, etc.) we can use that to make the decision easier. This is usually a holistic assessment but we can use benchmarks.

Y - Yell Intentions Loudly #

Alright this heading should really be more professional and start with “Communicate…” but I needed a “Y” and I like the visual. This could be a whole post in itself and I will probably write it eventually. In these situations there is a critical need for transparent and proactive communication, both with existing users and internal stakeholders. This process can be potentially disruptive and building trust and managing expectations can make or break the entire thing.

The last thing I’ll include here is that no good decision is made in a vacuum. When we feel a lot of pressure the tendency is to look inward and sit with the decision. Instead, include others early and often in the process. Leadership, stakeholders, managers, colleagues, and customers are all great resources for feedback. Every single part of the process above can and should be collaborative.

Wrapping It Up #

If us product people are to be believed, we truly revel in analyzing a complex situation. We leverage data effectively and make difficult decisions with clear understanding of potential consequences. We use our judgement and experience as necessary to steer a product through a transformation. That’s how we minimize risk, maximize the chance of success, and make tough decisions.